The Canary Islands Special Zone (ZEC) introduced its tax advantages at the Canary Islands International Cannabis Forum, more specifically during the economic conference on the business opportunities of the industrial sector in the Canary Islands.

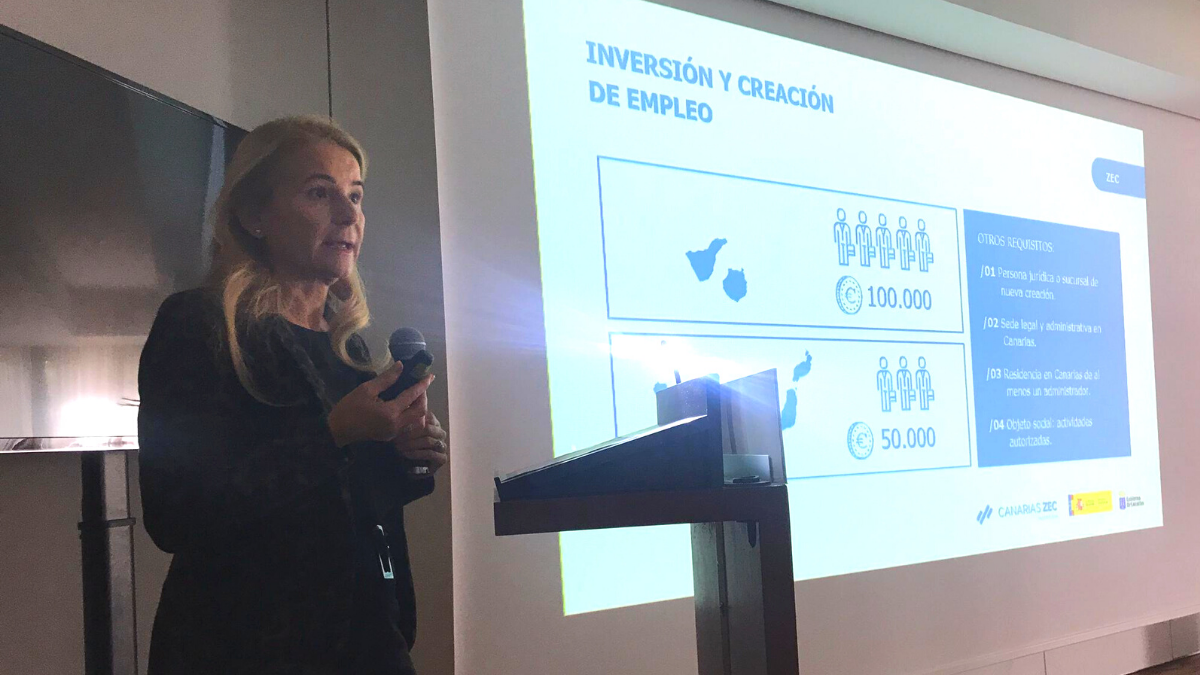

In addition to listing its attractive tax system for companies that intend to establish themselves in the islands with the aim of doing business in international markets, as well as explaining the requirements and procedures for creating a company under this low tax regime, the entity also highlighted the activities of this industrial sector with potential for the development of business models related to pharmaceuticals and R&D&I in the Canary Islands. In this respect, the ZEC regime can be applied to entities specialised in the cultivation of medicinal and pharmaceutical plants, the manufacture of basic and specific pharmaceutical products and, research and development in natural sciences and techniques, among others.

FICCA has a dual purpose: on the one hand, it is a platform for the dissemination of scientific and technological advances in the field of research on phytocannabinoids, for their medicinal and therapeutic use. At the same time, it has been designed as a space of sample and analysis of all the business possibilities in this new industry with the intention of positioning the Canary Islands in this sector. In its first edition, FICCA has had the collaboration of the institutional, university and business spheres.