The Canary Islands – The Canaries are so much more than a sun and beach destination. In the last few years, the islands have been projecting opportunities for business investment, given they have one of the most attractive tax regimes for companies operating on an international scale. In this context, the Canary Islands Special Zone (ZEC) has increased weight as it has become an effective fiscal policy instrument to attract companies that focus on diversification of the regional productive fabric through the establishment of entities working in key sectors with growth prospects. These companies are thus attracted to the islands and have made the archipelago a competitive economic base with high added-value employment.

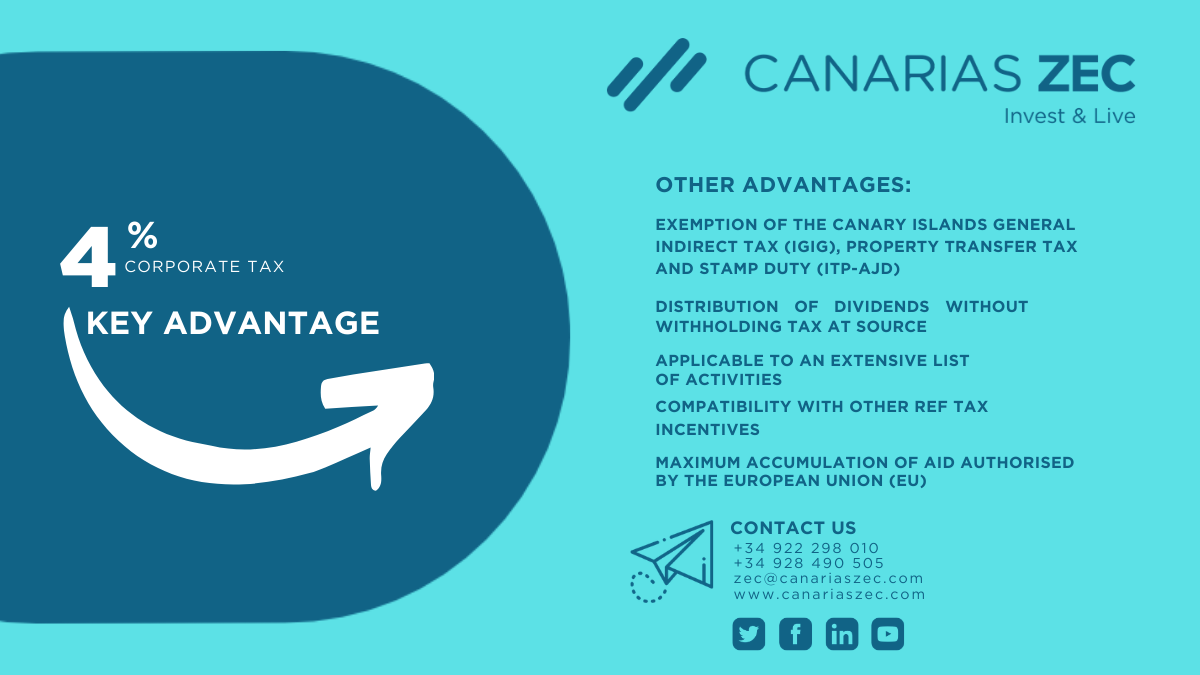

In the international promotion of the Canary Islands as an investment destination, the ZEC is a strategic element, since it is a tool that offers companies the most competitive taxation in Europe with a 4% rate on Corporate Tax. A great many advantages can be added to this: distribution of dividends without withholding tax at source, the exemption of the Canary Islands General Indirect Tax (IGIC) on imports, on the delivery of goods and the provision of services between ZEC companies, as well as the exemption of the Tax on Capital Transfers and Documented Legal Acts, in addition to the possibility of combining these incentives with other tax and economic incentives aimed at promoting business activity in the Canary Islands or offering the maximum accumulation of aid authorised by the European Union.

All these advantages added to the geographical strategic position of the Canary Islands for international trade, have led more than six hundred companies to operate from the archipelago on international markets using the islands as a business platform under the conditions set by this aid with a regional aim, which has been in operation since 2000.