Canary Islands.-The Canary Islands is one of the outermost territories of the European Union (EU) that has a unique tax system to boost its economy and diversify its productive fabric with one of the types that taxes the profits of the most low in the EU: the Canary Islands Special Zone (ZEC), thus being the region with the most competitive type of Companies.

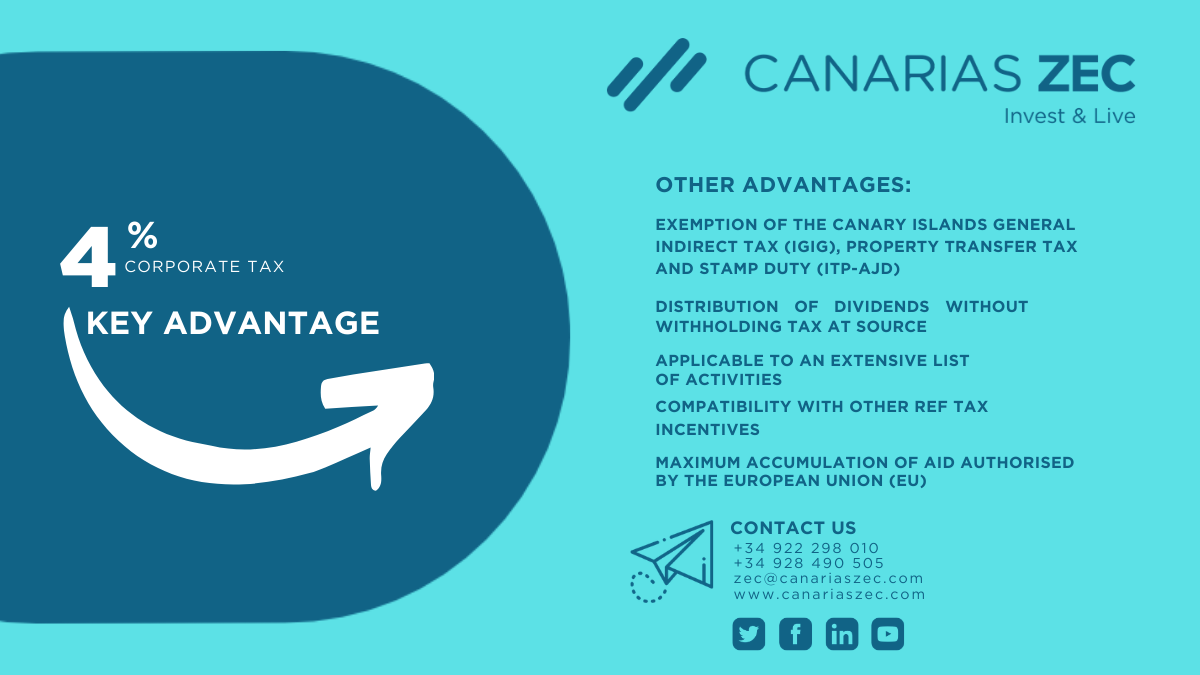

Through its Economic and Fiscal Regime (REF) of the Canary Islands, incentives are articulated, among these, the ZEC, which is a low tax regime, whose star advantage is that companies, which comply with a series of requirements both in the activity , as in the creation of employment and generation of investment, pay 4% in Corporation Tax. This instrument is authorized by the EU and the governments of Spain and the Canary Islands. The rate of Corporation Tax is the ZEC is 4% compared to 21% of the EU average. In other words, the effective rate of Corporation Tax is 17% lower than the average of the EU Member States.

This is a plus for competitiveness, also if it is taken into account that with the limit of the Community regulations on accumulation of aid and under certain conditions, the tax advantages of the ZEC are compatible with other incentives of the REF.