Canary Islands.- The tax advantages of the Canary Islands Special Zone (ZEC) regime have fostered its growth as an investment destination for companies related to Information and Communication Technologies (ICT); a business segment that has gained prominence in the sector ranking, whose figures show that taxation is a strength to exploit its potential. The ZEC is itself a platform for ICT companies, since no less than 20% of the companies operating under this low-tax regime are grouped into activity.

In the context of an increasingly globalized economy, ICTs become one of the axes of the digital economy, since in addition to generating innovation, they increase productivity, enhance competitiveness and generate employment; pillars to ensure business success. This sector, in addition to contributing to economic growth through turnover and job creation, represents a giant step forward in the strategy to diversify the regional productive fabric. The digital economy concentrates the capacity for the future transformation of our economic and social fabric.

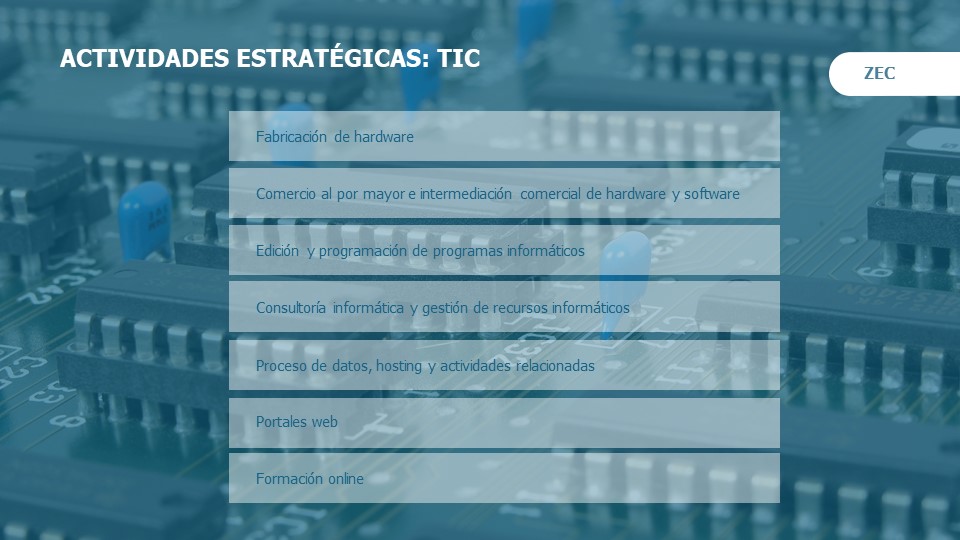

Within the ICT as strategic sectors in the framework of the ZEC are: the manufacture of hardware; wholesale trade and trading of hadwarwe and software; editing and programming of computer programs; computer consultancy and management of computer resources; data processing; hosting and related activities; web portals and online training. All these key activities are taxed in the Canary Islands with full legal security at 4% in Corporation Tax, in addition to being able to be combined with other business incentives.

On the other hand, in general terms, according to the data collected in the Annual Report on the Information Society in the Canary Islands 2019 (Informe eCanarias 2019) prepared by the Canary Observatory of Telecommunications and the Information Society (OCTSI), the The Canary Islands ICT sector was made up of 2,518 companies representing 4.1% of the Spanish ICT sector.